Disaster Funding

COVID-19 and Trade Associations: The Impact So Far

Given shut down orders, social distancing, and travel restrictions, trade associations are facing extraordinary financial losses due to in-person event cancellations. Further losses are being experienced in dues revenue as members look for ways to reduce their own expenses. According to the Professional Convention Management Association, conferences and events account for an estimated 35 percent…

Read MoreTrade Associations, COVID-19 and the CARES Act

We know there isn’t any industry unaffected by COVID-19. That said, there’s been little discussion of the impact of the pandemic on trade associations. Trade associations are known for their role in providing information, support, advocacy, and training to industry members and to the professionals employed in those industries. They provide important information and resources,…

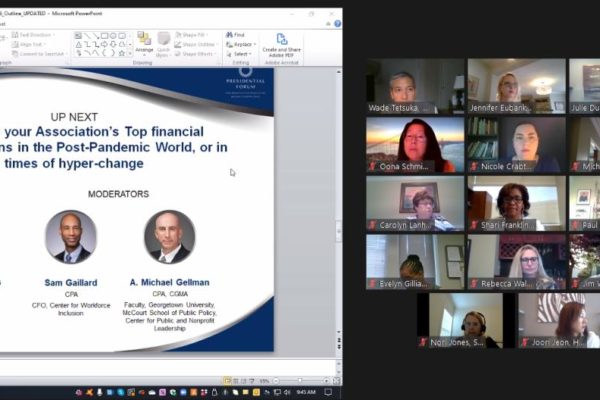

Read MoreJennifer Eubanks Moderated – Presidential Forum Discussion

Jennifer Eubanks Moderated – Presidential Forum Discussion regarding Association Top Financial Considerations in the Post-Pandemic World, or in times of hyper-change

Read MoreHow COVID 19 Changed the Financial Operations of Non-Profit Organizations

As COVID 19 changes the economic landscape in the United States, many non-profit organizations are experiencing dramatic changes in their operations, financial security and future plans. At the same time, these organizations see a greater need for their services, both in the near term and throughout recovery. As events are cancelled, including fundraisers, annual meetings,…

Read MoreEubanks Accounting & Advisory’s Jennifer Eubanks attending Capitol Hill Week to Promote PPP Legislation on June 11

We’re excited to have a direct line of communication with the Members of Congress that represent us. Now more than ever, our small business voices need to be heard!

Read MoreTax Implications of Coronavirus Relief

A number of tax implications evolve as a result of relief provided by the Coronavirus Aid, Relief and Economic Security (CARES) Act, and the Families First Coronavirus Response Act (FFCRA). We’ve created a summary of information as it has evolved to date.

Read MoreMurky Waters for Government Contractors Receiving PPP Funds

Government contractors, constantly vigilant and monitoring compliance with Federal Acquisition Regulations are faced with unprecedented uncertainty and questions surrounding acceptance of Paycheck Protection Program (PPP) funds and payments under Section 3610 of the CARES Act. Contractors must consider a) the ban against ‘double dipping’ of funds and b) must also consider that loan forgiveness under the PPP may be interpreted as a credit due back to the government in accordance with FAR 31.201-1 (a).

Read MoreSmall Businesses Suffer with SBA Out of Funds

On Thursday April 16th, just 14 days after small businesses across America were first able to apply for loans through the $349 billion Paycheck Protection Program, the U.S. Small Business Administration announced it had exhausted its allotted funds and stopped accepting applications. Ironically, Capital One and Wells Fargo opened their application portals within the last two days…

Read MoreSBA Issues New Interim Rule – Temporary Changes Impacting Self-Employed and Partnership Access to PPP Loans

We’ve received many questions from individuals with self-employment income filing on Form 1040 with a Schedule C. The repeated question is whether these individuals are eligible for a PPP loan, and if so, how to determine the maximum loan amount. The new interim rule answers this question. If you have no employees, the following methodology…

Read MoreCARES Act – Tax Savings and Business Opportunities

Small Businesses may be able to take advantage of a number of tax savings and cost deferral opportunities presented by the CARES Act. Read on to learn about a few of the provisions and potential savings. Deferral of employer Social Security tax You can generally defer the employer share of the 6.2% Social Security tax…

Read More