Industry News

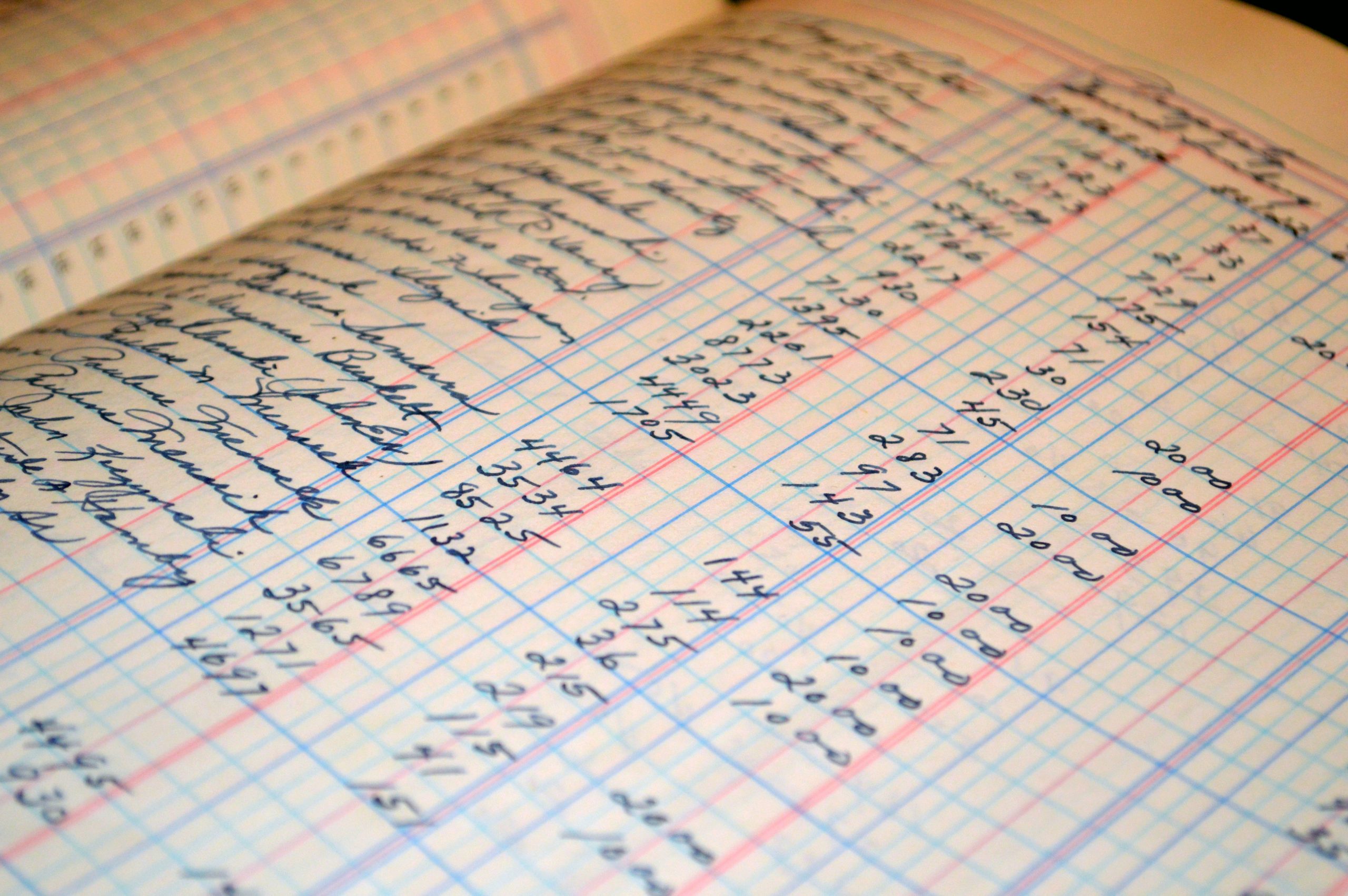

Accounting Outsourcing… Leading the New Normal

We all believed that to ensure the productivity of our employees and to keep the business running smoothly, we had to do the hour commute, spend 8 to 10 hours tethered to our desks and participate in in-person meetings five days a week. You know, back in February. Rare were the companies that allowed employees…

Read MoreEubanks Accounting & Advisory’s Jennifer Eubanks attending Capitol Hill Week to Promote PPP Legislation on June 11

We’re excited to have a direct line of communication with the Members of Congress that represent us. Now more than ever, our small business voices need to be heard!

Read MoreHelp for Small Businesses in VA

Virginia Governor Ralph Northam released Workforce Innovation and Opportunity Act (WIOA) Rapid Response funding to support Northern Virginia employers to remain open during this emergency. The funds are intended to assist local employers to avert layoffs and support other operational needs. These strategies and activities are designed to prevent, or minimize the duration of, unemployment…

Read MoreTax Credits Provided to Small Businesses

The Family First Coronavirus Response Act requires Small Businesses to provide Emergency Family and Medical Leave, and Paid Sick Leave for employees. It also provides tax credits to small businesses. The FFCRA includes a 100 percent payroll tax credit for qualified sick leave wages paid under the EPSLA and for qualified family leave wages paid…

Read MoreDeductions Denied for Failure to Substantiate – Penalties Imposed

The Tax Court requires taxpayers to substantiate business expenses or face stiff penalties. As we enter another tax season, the deductibility of expenses will be in the forefront of business owner’s minds. The Tax Court took a strong position on the matter in this 2006 court case, placing the burden of substantiation on taxpayers to…

Read More