Posts Tagged ‘Jennifer Eubanks’

Local Business Owner Jennifer Eubanks Named to NSBA Leadership Council

Hendon, VA – Jennifer Eubanks, CPA Department, Virginia was recently named to the National Small Business Association (NSBA) Leadership Council. NSBA is the nation’s oldest small-business advocacy organization, and operates on a staunchly nonpartisan basis. Eubanks, a recognized leader in the small-business community, joins the NSBA Leadership Council alongside other small-business advocates from across the…

Read MoreUnrelated Business Income – Latest Update Nonprofits and Associations

January 13, 2021 Jim Niblock, CPA Department’s Senior Manager of Tax Services and Jennifer Eubanks present Unrelated Business Income – Latest Update Nonprofits and Associations Register Now

Read MoreTax Implications of the Cares Act

December 29, 2020 Jim Niblock, CPA Department’s Senior Manager of Tax Services and Jennifer Eubanks present Tax Implications of the Cares Act Register Now

Read MoreCash Management through Crisis for Nonprofits & Associations

Dan O’Dea, CPA Department’s Director of Outsourced Accounting and Jennifer Eubanks present ‘Cash Management through Crisis for Nonprofits & Associations Register Now

Read MoreTop 7 reasons companies Outsource Accounting and Back-office functions

By Jennifer Eubanks 1. Competent financial management, reporting, and guidance. Businesses need to have competent financial management, reporting, and guidance so the management team can focus on operations. 2. Businesses need the right people. Some 70 percent of KPMG survey respondents said they are outsourcing accounting to get access to better talent. This helps clients focus on their business instead…

Read More4 Tax Provisions CARES Put Into Place You Should Pay Attention To

Businesses are facing challenges not seen previously due to COVID-19. Many industries have been significantly impacted, some have been decimated, and most have been impacted to some extent by the COVID-19 outbreak. To help businesses survive this turbulent time, the federal government put the CARES Act (Coronavirus Aid, Relief, and Economic Security Act) into effect.…

Read MoreAccounting Outsourcing… Leading the New Normal

We all believed that to ensure the productivity of our employees and to keep the business running smoothly, we had to do the hour commute, spend 8 to 10 hours tethered to our desks and participate in in-person meetings five days a week. You know, back in February. Rare were the companies that allowed employees…

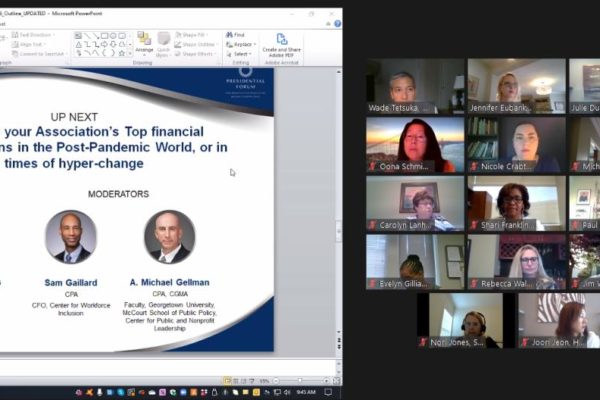

Read MoreJennifer Eubanks Moderated – Presidential Forum Discussion

Jennifer Eubanks Moderated – Presidential Forum Discussion regarding Association Top Financial Considerations in the Post-Pandemic World, or in times of hyper-change

Read MoreCapitol Hill Speaking Engagement

Capitol Hill Speaking Engagement – Jennifer Eubanks attended Capitol Hill meetings with a group of Goldman Sachs 10KSB graduates to speak with our representatives in Congress and tell the stories of small businesses on June 11 – to promote PPP Legislation.

Read MoreCPA Department’s Jennifer Eubanks attending Capitol Hill Week to Promote PPP Legislation on June 11

We’re excited to have a direct line of communication with the Members of Congress that represent us. Now more than ever, our small business voices need to be heard!

Read More