Posts Tagged ‘small business’

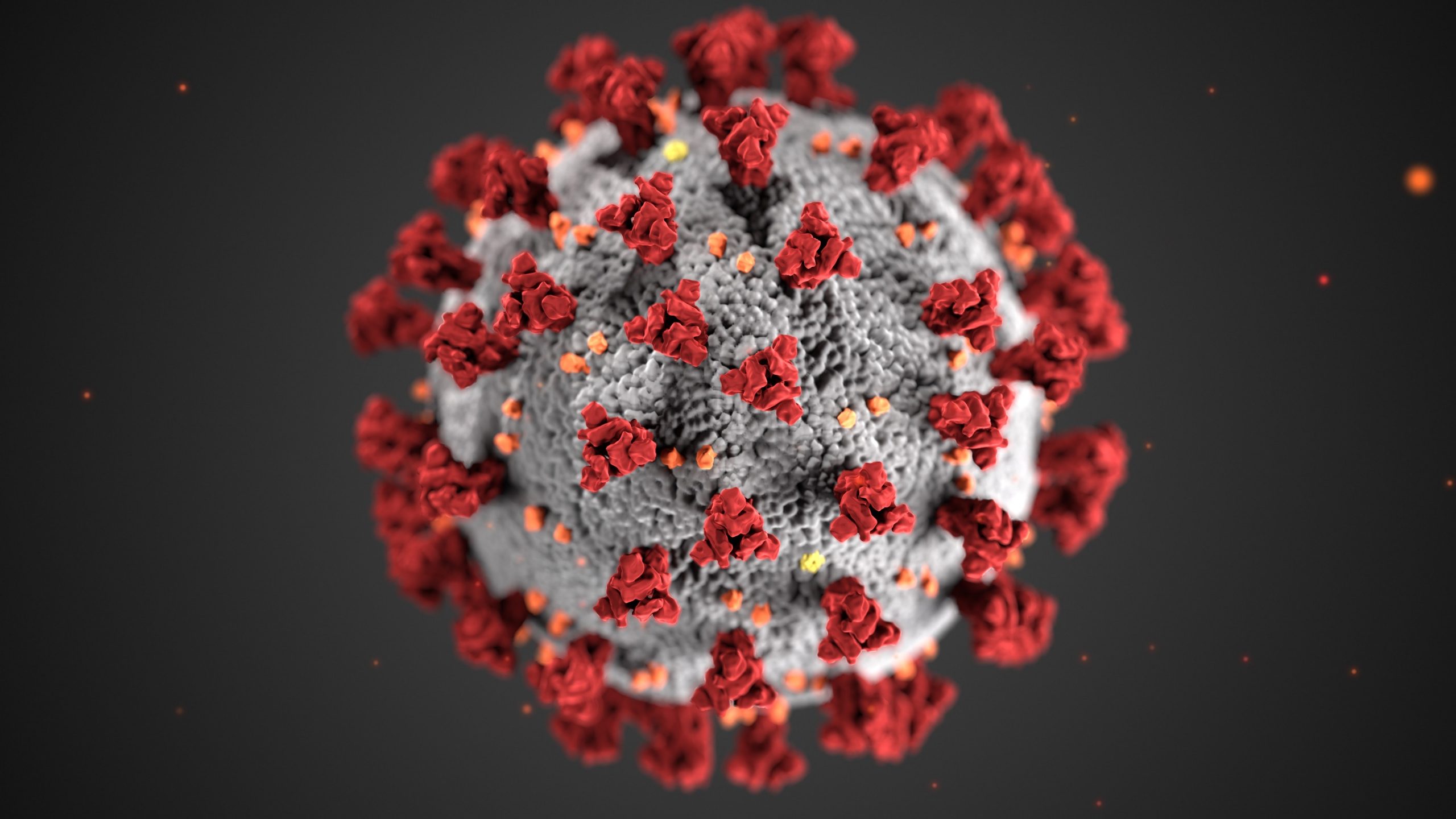

For Individuals: New COVID-19 Federal Assistance – CARES Act

The Cares Act, passed March 27, 2020, provides economic relief to individuals to help families cope with the financial impact of the pandemic. Below follows a summary of the provisions, with more to come as details unfold. Provisions for Individuals Retirement Plans Withdrawals no 10% penalty on early withdrawals up to $100,000 for coronavirus-related distributions.…

Read MoreSBA EIDL Help for Small Businesses

Economic Injury Disaster Loan (EIDL) from the SBA The Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020 Providing help to small businesses through the U.S. Small Business Administration (SBA) through low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). Read an overview of…

Read MoreBusiness Tax provisions

Employers are eligible for a 50 percent refundable payroll tax credit on wages paid up to $10,000 during the crisis. It would be available to employers whose businesses were disrupted due to virus-related shutdowns and firms experiencing a decrease in gross receipts of 50 percent or more when compared to the same quarter last year. The credit…

Read MoreLatino Economic Development Corp – Tax Planning and Reporting for Small Business

March 19, 2020 Jennifer Eubanks Presentation, with Rod Johnson of the Small Business Administration – Latino Economic Development Corp – Tax Planning and Reporting for Small Business

Read More