Corporate

Accounting for Nonprofits vs For-Profits: A CPA’s Perspective

As a certified public accountant (CPA), I have worked with both nonprofit and for-profit organizations and have seen the differences in how they account for their financial activities. Here, I will explain three of the main differences between accounting for nonprofits and for-profits, and why they matter. What is a Nonprofit Organization? A nonprofit organization…

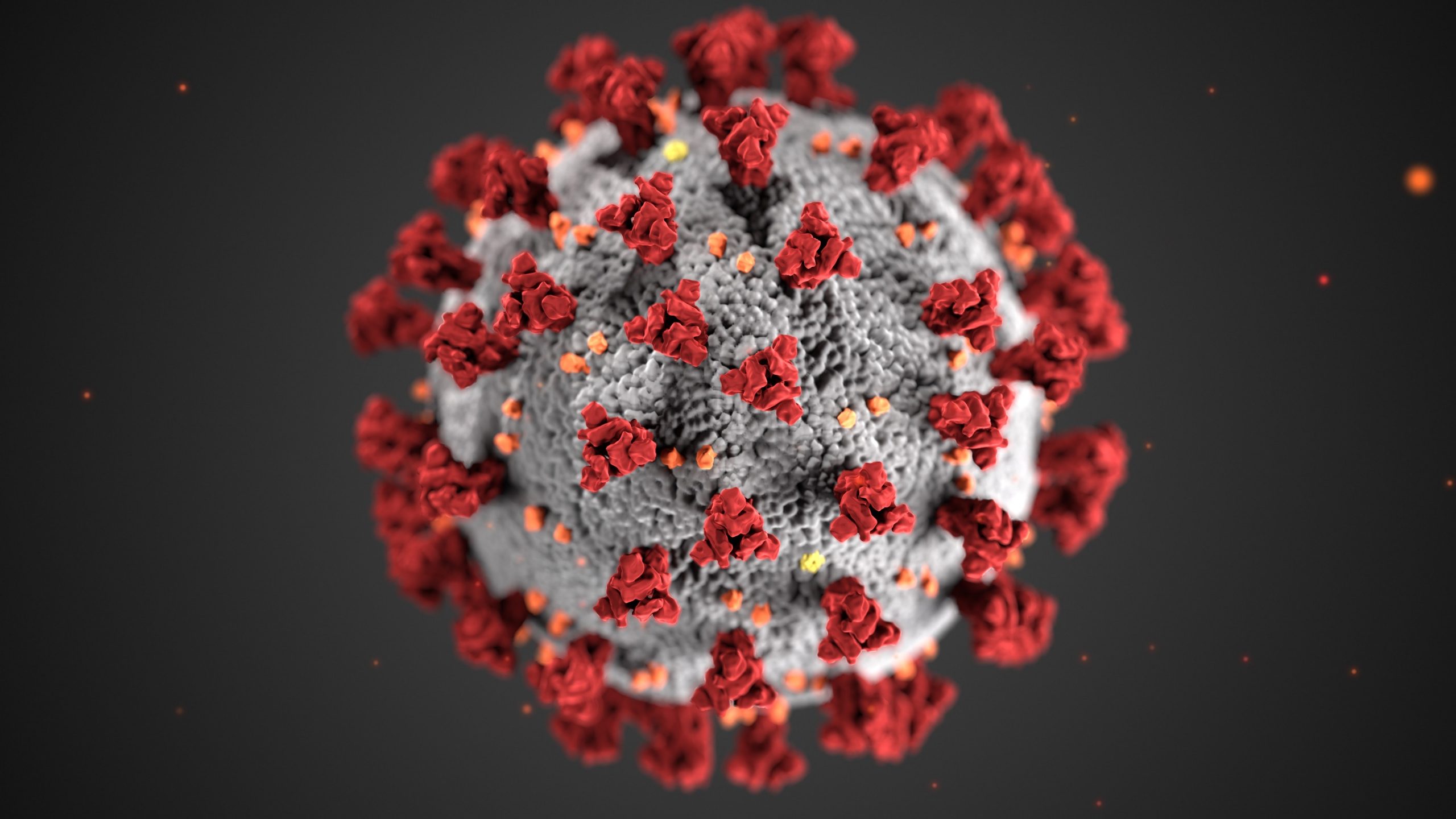

Read MoreCOVID-19 and Trade Associations: The Impact So Far

Given shut down orders, social distancing, and travel restrictions, trade associations are facing extraordinary financial losses due to in-person event cancellations. Further losses are being experienced in dues revenue as members look for ways to reduce their own expenses. According to the Professional Convention Management Association, conferences and events account for an estimated 35 percent…

Read MoreTop 7 reasons companies Outsource Accounting and Back-office functions

By Jennifer Eubanks 1. Competent financial management, reporting, and guidance. Businesses need to have competent financial management, reporting, and guidance so the management team can focus on operations. 2. Businesses need the right people. Some 70 percent of KPMG survey respondents said they are outsourcing accounting to get access to better talent. This helps clients focus on their business instead…

Read MoreAccounting Outsourcing… Leading the New Normal

We all believed that to ensure the productivity of our employees and to keep the business running smoothly, we had to do the hour commute, spend 8 to 10 hours tethered to our desks and participate in in-person meetings five days a week. You know, back in February. Rare were the companies that allowed employees…

Read More5 Steps to Setting Up a US Company for Non-US Resident

As a foreign business looking to establish an international footprint, there are numerous advantages if you start a business in the United States. Taxes tend to be lower than in many parts of the world, access to selling into the U.S. market is easier when a business is established within the country, and the legal…

Read MoreFairfax County Help For Businesses due to Covid-19

Families First Emergency Family and Medical Leave Expansion Act

Help for Employers and Employees Emergency Family and Medical Leave Act Requires companies with fewer than 500 employees to provide paid time off. Employers with fewer than 50 employees may be exempt if it would “jeopardize the viability of the business” Employers with fewer than 500 employees now must allow employees who have been employed…

Read MoreSBA EIDL Help for Small Businesses

Economic Injury Disaster Loan (EIDL) from the SBA The Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020 Providing help to small businesses through the U.S. Small Business Administration (SBA) through low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). Read an overview of…

Read More