Posts Tagged ‘accounting’

Tax Implications of Government Contract Types: Choosing the Right Fit for Your Business

When it comes to government contracting, the type of contract you choose can significantly influence your business’s tax obligations, financial reporting, and overall profitability. When securing contracts, understanding the tax implications of each government contract type is critical. Making informed decisions about contract structures can optimize tax efficiency, minimize liabilities, and improve compliance with government…

Read MoreCompliance as a Growth Driver: Accounting for Commercial and Government Funded Contracts

Many research and development heavy companies pursue groundbreaking research and develop products aimed at improving various aspects of life. These companies’ missions are not only to advance science and technology but also to secure funding from both private and federal sources to fuel ambitious projects. As these companies embark on this journey, they face critical…

Read MoreAccrual vs Cash Accounting for Small Businesses: Which is Right for You?

As a small business owner, you regularly make decisions directly affecting your finances and taxes. One of your most important decisions is choosing the right accounting method for your business: accrual or cash. Both methods have advantages and disadvantages. The best one for you depends on your business type, size, goals, and preferences. What is…

Read MoreUnderstanding Allowable Costs Speeds Reimbursement: 6 Best Practices for Avoiding Unallowable Costs

Understanding which costs may be allocated to a direct or indirect project, and billed to the government as an allowable cost speeds reimbursement of expenses, and helps avoid potential government penalties. The Federal Acquisition Regulations (FAR) provides official guidance and numerous examples of allowable and unallowable costs. Here we will discuss what is and is…

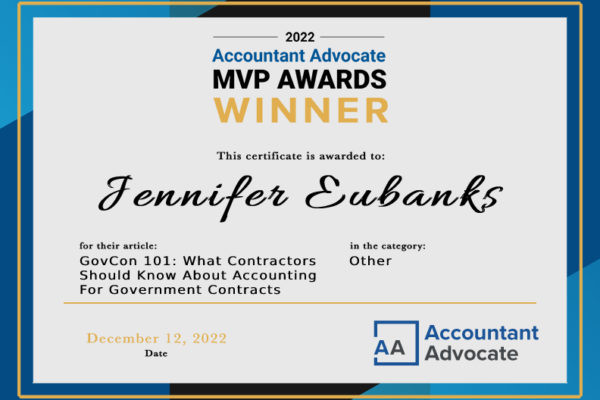

Read MoreJennifer Eubank’s Article Wins 2022 Accountant Advocate MVP Awards.

Jennifer Eubank’s article GovCon 101: What Contractors Should Know About Accounting For Government Contracts,” has won 1st place in the 2022 Accountant Advocate MVP Awards Other category! To learn more, visit here.

Read MoreGovCon 101: What Contractors Need To Know About Indirect Rates

Jennifer Eubanks recently authored the council post, GovCon 101: What Contractors Need To Know About Indirect Rates In the first article of this series of articles related to selling to the federal government, I discussed federal acquisition regulations (FAR), cost accounting standards (CAS) and the types of contracts issued by government agencies. In the second article, I expanded…

Read MoreGovCon 101: What Contractors Should Know About Accounting For Government Contracts

Jennifer Eubanks recently authored the council post, GovCon 101: What Contractors Should Know About Accounting For Government Contracts In a prior article, I wrote about the appeal of counting the Federal Government as a customer, because of the size of the government’s budget, as well as its creditworthiness. In that article, I discussed Federal Acquisition Regulations…

Read MoreJennifer Eubanks Forbes Feature Article: What Prospective Contractors Need To Know When Preparing To Bid For A US Federal Government Contract

Jennifer Eubanks was recently featured on Forbes with her article: What Prospective Contractors Need To Know When Preparing To Bid For A US Federal Government Contract It can be appealing to count the federal government as a customer. The government spends significantly each year and pays its bills. Furthermore, government spending typically increases in times…

Read MoreWhat is an Adequate Accounting System? 10 Questions to Determine if Your Accounting System is Adequate for Government Contracts

In many cases, having an “adequate accounting system” is an integral part of successfully winning and performing on Federal contracts. Many companies find it challenging to determine when accounting system requirements are triggered and how to navigate obtaining a determination of adequacy. Our clients and prospects unanimously have the same questions. Since these questions are…

Read MoreJennifer Eubanks Contribution to Forbes Expert Panel: 14 Important Financial Steps When Bringing On Remote Staff From Different Locations

Jennifer Eubanks recently contributed to a council post, 14 Important Financial Steps When Bringing On Remote Staff From Different Locations With more and more companies implementing permanent remote work policies, businesses are widening their talent pool to find the best people for the job, regardless of location. As businesses expand their remote teams by adding new members…

Read More