Posts Tagged ‘Corporation’

2020 Year-end Charitable Giving Tax Incentives for Corporations

Once again, the grocery store bell ringers are out with red buckets seeking spare change in this giving time of the year. Yet a pall rests over the season due to pandemic-related economic reversals felt by even the jolliest of citizens. It is rumored that Rudolph, Prancer, and Vixen were furloughed, and Santa will lighten…

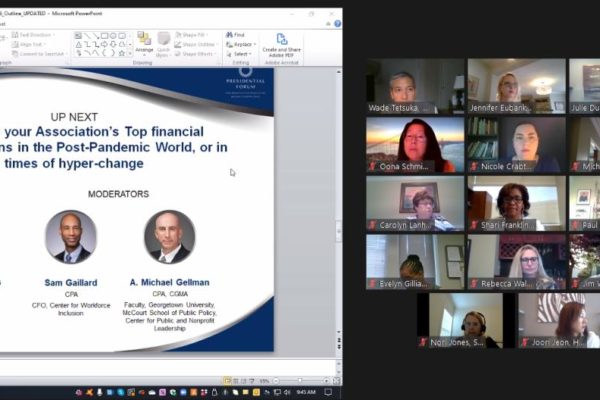

Read MoreJennifer Eubanks Moderated – Presidential Forum Discussion

Jennifer Eubanks Moderated – Presidential Forum Discussion regarding Association Top Financial Considerations in the Post-Pandemic World, or in times of hyper-change

Read More5 Steps to Setting Up a US Company for Non-US Resident

As a foreign business looking to establish an international footprint, there are numerous advantages if you start a business in the United States. Taxes tend to be lower than in many parts of the world, access to selling into the U.S. market is easier when a business is established within the country, and the legal…

Read MoreGMU – Corporate Tax Implications of COVID-19

Presentation – GMU 2pm on Ma 28, 2020 Christine Landoll moderating a discussion with Jennifer Eubanks, Stephen Lawson, and Lina Ivanova on the effects of #covid19 on #corporatetaxes.

Read MoreCapital One still not accepting applications for the Paycheck Protection Program

While most banks have successfully rolled out online portals to accept Payroll Protection Program applications, Capital One remains closed for applications. Businesses who bank with Capital One are looking for other options. Below is a link to a list of banks taking applications from new customers, compiled by Forbes Magazine. https://www.forbes.com/sites/brianthompson1/2020/04/09/banks-and-fintech-companies-accepting-paycheck-protection-program-loan-applications-from-new-and-non-bank-customers/#599f3af8b950 We understand Gusto is…

Read MoreGoogle Tells us Who is Moving Around

Check the link below to see what Google tells you about the movement in your area. Google’s report tells us how we are responding to orders to stay home and shelter in place. How are we doing? Cutting to the chase: we are moving around less, and staying home more – but not all of…

Read MoreStep by Step Guidance and Application Forms – A Small Business Owner’s Guide to the CARES Act

Please open or download this guide from the US Chamber of Commerce for detailed, step by step instructions for accessing assistance. The following files contain documents to assist calculating the Payroll Protection Act Loan amount, as well as the Borrower Application and Program Details.

Read MoreInterest on all student loans held by the Federal Government Waived due to COVID-19

Contact your loan servicer online or by phone to determine if your loans are eligible. Your servicer is the entity to which you make your monthly payment. If you do not know who your servicer is or how to contact them, visit StudentAid.gov/login or call 1-800-4-FED-AID. See link below for more information from studentaid.gov, including Q&A. https://studentaid.gov/announcements-events/coronavirus

Read MoreComprehensive List of Private and Public Loans, Grants, and Financial Support for Small Businesses

In light of the global COVID-19 pandemic, federal, state, and local governments, along with private entities, are mobilizing to provide economic relief as businesses and workers enter a period of uncertainty. Gusto compiled a comprehensive list of public and private loans, grants, and financial support programs aimed at small businesses: https://docs.google.com/spreadsheets/d/1SRBZE2_6Nftwd02M6Oxj8MoeuZ7y93spXIgIPhkkp2w/htmlview#gid=0

Read MoreNew Guidance from the DOL on Administering FFCRA Leaves

The DOL has provided Questions and Answers document for employers, to provide guidance ahead of the implementation date on Wednesday, April 1. The following are some highlights from the updated guidance: These leaves are not available to employees with reduced hours, furloughed employees, or employees whose workplaces are closed. See questions 23-28. These leaves are…

Read More