Posts Tagged ‘Eubanks Accounting & Advisory’

Tax Implications of Government Contract Types: Choosing the Right Fit for Your Business

When it comes to government contracting, the type of contract you choose can significantly influence your business’s tax obligations, financial reporting, and overall profitability. When securing contracts, understanding the tax implications of each government contract type is critical. Making informed decisions about contract structures can optimize tax efficiency, minimize liabilities, and improve compliance with government…

Read MoreThe GovCon’s Guide to DCAA Incurred Cost Submissions

For government contractors operating under cost-reimbursable or time-and-material (T&M) contracts, DCAA Incurred Cost Submissions (ICS) are more than just an annual requirement—they’re a critical component of maintaining compliance and securing timely reimbursements. A well-prepared Incurred Cost Proposal (ICP) not only ensures adherence to Federal Acquisition Regulation (FAR) Part 52.216-7, but also positions your company for…

Read MoreWhy You Need a Government Contracts CPA to Work on Your Government Contracting Business Taxes

Taxes are an essential element of financial planning for any business, but when it comes to government contracting, the stakes are significantly higher. The interplay of federal regulations, cost accounting standards, and tax codes requires specialized expertise to ensure compliance and optimize financial performance. A Government Contracts CPA (Certified Public Accountant) helps contractors meet these…

Read MoreWhy is Using a Government Contracts Accountant Important?

Government contracting introduces unique financial and regulatory challenges that can overwhelm even experienced businesses. Ensuring compliance, managing costs, and navigating federal requirements often requires specialized knowledge. The right expertise can transform these challenges into strategic opportunities for sustainable revenue growth and help avoid costly missteps. A Government Contracts Accountant (GCA) plays a pivotal role in…

Read MoreUnderstanding How to Bid on Government Contracts: A Guide for Government Contractors

The process of bidding on government contracts can be both challenging and rewarding for contractors. With the potential for lucrative and stable revenue streams, understanding the intricacies of government contracting is essential. Successful government contractors follow key steps and strategies to submit winning bids on government contracts. Why Bid on Government Contracts? Bidding on government…

Read MoreA Complete Government Contract Compliance Checklist: A Guideline for Success

In the government contracting sector, compliance is not just a requirement but a competitive advantage. Adhering to the complex web of regulations, standards, and requirements is essential for securing and maintaining lucrative contracts. Government contractors must be vigilant, ensuring every aspect of their operations aligns with regulatory expectations. This comprehensive checklist will help government contractors…

Read MoreWhat is an Adequate Accounting System for Contract Proposals?

An adequate accounting system is not just a helpful asset—it is the cornerstone of your financial strategy. This system is the backbone that ensures compliance with stringent regulations, manages costs with precision, and significantly boosts your chances of securing lucrative government contracts. Grasping the essentials of an adequate accounting system for proposals is crucial, as…

Read MoreCompliance as a Growth Driver: Accounting for Commercial and Government Funded Contracts

Many research and development heavy companies pursue groundbreaking research and develop products aimed at improving various aspects of life. These companies’ missions are not only to advance science and technology but also to secure funding from both private and federal sources to fuel ambitious projects. As these companies embark on this journey, they face critical…

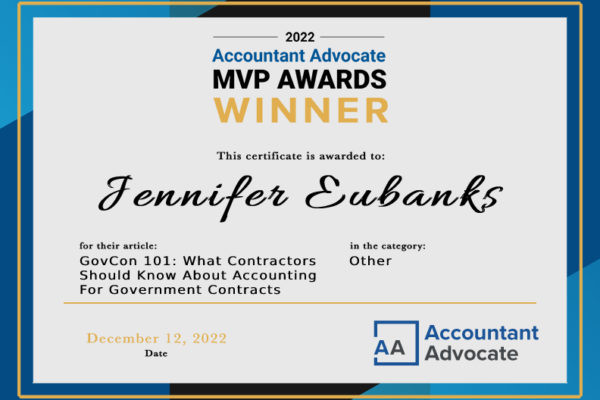

Read MoreJennifer Eubank’s Article Wins 2022 Accountant Advocate MVP Awards.

Jennifer Eubank’s article GovCon 101: What Contractors Should Know About Accounting For Government Contracts,” has won 1st place in the 2022 Accountant Advocate MVP Awards Other category! To learn more, visit here.

Read MoreGovCon 101: What Contractors Need To Know About Indirect Rates

Jennifer Eubanks recently authored the council post, GovCon 101: What Contractors Need To Know About Indirect Rates In the first article of this series of articles related to selling to the federal government, I discussed federal acquisition regulations (FAR), cost accounting standards (CAS) and the types of contracts issued by government agencies. In the second article, I expanded…

Read More