How Work From Home Might Affect This Year’s Tax Returns

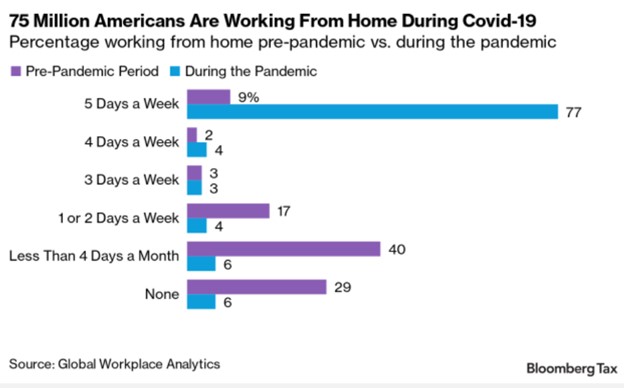

Back in March of 2020, our world suddenly shifted, and so did our place of work. Most of us found ourselves creating spur-of-the-moment home offices, navigating how to perform our jobs virtually while possibly also homeschooling our children, and putting systems into place to run a business from a remote setting. Now, as we head into tax season with many of us having spent a part or most of 2020 working from home, surprises may await us, as working from home may affect this year’s tax returns.

At the root of the problem we are facing as a country regarding taxes is tax nexus, which is based on where employees perform their actual work. What happens for those who live in one state and have previously commuted to another?

In a year that has been nothing but “unprecedented”, we could face unprecedented tax implications as well. And Congress is aware of this issue. With only 25% of states issuing guidance, there is growing pressure on Congress to pass the federal mobile worker relief law that Sen. John Thune (R-S.D.) has promoted for several years.

What are the Potential Implications of Working from Home due to the Pandemic?

Implications exist for both businesses and individuals.

Most states claim that employees working within their state give the employer nexus there for the purpose of taxation. So, in a typical year, just one employee from a company working in a particular state, no matter what connections or lackthereof existed between that state and the company, could subject the company to tax withholding in that location.

This means wherever you work is where you owe taxes. And with so many of us working from home this year, that could mean employers could potentially owe more.

Here’s where it gets even more confusing, and challenging for employers and employees, alike. What if you work in New York City, live in New Jersey, and flew to stay with your cousin out west in the beginning of the pandemic? Now, one employee has three places in which they are performing work, 3 different states where tax withholdings may be required. For the company, a potential tax liability exists in each state, and payroll departments are likely responsible for witholding state payroll taxes for each state. For individuals, having state taxes withheld means multiple state tax returns to file, and potentially double taxation on income earned.

What You Can Do (hire a professional this year; check your state; home office)

If you’re worried about how work-from-home might affect your taxes, there are some actions you can take to ease your mind and potentially save money:

- Those who are self-employed or gig workers are able to use their home offices as tax write offs. However, in 2017, the Tax Cuts and Jobs Act eliminated the tax deductions for maintaining a home office for those who are employees and not self-employed .

- Employers and employees alike should check with work and home states. For employers, many states have agreed this year, given the situation, that employees working remotely due specifically to COVID-19 restrictions does not create nexus. . Therefore, in those states, employers would not have to pay additional taxes. For employees, some states have agreed workers are required to have taxes withheld only by the state in which the business is located. Do some research to understand if your state has issued any legislation on this topic.

- 2020 was a unique year, with significant economic legislation to ease the impact of the pandemic and resultant financial crisis. Whether considering a tax return for a business, or the impact on your personal income taxes, don’t hesitate to reach out to a professional to help younavigate through tax season. If your company has a number of employees working out-of-state, discussing the issue with a CPA and having them guide you and your payroll department through the process of identifying proper state withholdings from employees will reduce potential liabilities for underwithholdings.

The events of 2020 impacted the way people work, likely permanently. The forced adaptation to work-from-home in March of last year has now caused many businesses to employ more remote workers than ever before. As your business navigates the current environment and possibly moves permanently towards this model, be sure to keep in mind how it will affect taxation of the company itself and of its employees.

Resources

https://www.accountingtoday.com/opinion/the-work-from-home-tax-crisis-we-have-to-see-coming

https://www.kiplinger.com/taxes/601689/tax-wrinkles-for-work-at-home-employees-during-covid-19

https://www.natlawreview.com/article/covid-19-state-tax-implications-remote-working-arrangements